While the company said it’s notifying affected people, there are two separate databases, made available by online security companies, where consumers can see if they were among the victims. In other words, your data may have been compromised long before the latest incident, which AT&T says affected 73 million current and former customers. AT&T began notifying impacted customers via letters or email starting in April. Those customers should have received an offer for free credit monitoring. That hacker claimed the stolen files include 2.7 billion records, with each listing a person’s full name, address, date of birth, Social Security number and phone number, Bleeping Computer said.

Place A Fraud Alert Or Credit Freeze

You can pay for credit monitoring but that is probably more than most people need to do. Following a loss or theft, you should keep a close eye on your credit reports, as these can be your first indication of identity theft. Even if you haven’t noticed any signs of identity theft, if your SSN has been exposed, it’s pretty much a matter of time. You can sign up for an identity theft protection service to get ahead of identity thieves.

- An IP PIN is a six-digit number you’ll get from the IRS, and you’ll get a new one each year.

- Also, never share your personal information while using public internet.

- Someone illegally using your Social Security number (SSN) and possibly assuming your identity can cause many problems.

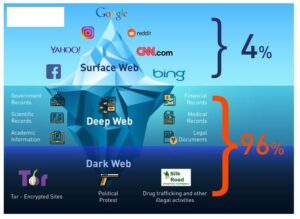

- When your SSN appears on the dark web, it means that cybercriminals potentially have access to this sensitive data and could use it for nefarious purposes.

- Keep a close eye on your bank accounts, credit card statements, and any other financial accounts.

You can freeze and unfreeze your credit report for free, but you’ll need to contact each credit bureau separately to implement the freeze. Social security information is often used for financial fraud, particularly related to insurance and credit cards. Suspicious banking activity is one of the first signs that something might be up.

It’s free to use and you can get an account even if you don’t receive benefits. Remember, taking immediate action is crucial when your SSN is on the dark web. By following these steps and staying vigilant, you can minimize the potential damage and protect yourself from further harm. It’s important to note that not all activities on the dark web are illegal.

Experian is a globally recognized financial leader, committed to being a Big Financial Friend—empowering millions to take control of their finances through expert guidance and innovative tools. As a trusted platform for money management, credit education, and identity protection, our mission is to bring Financial Power to All™. When your SSN appears on the dark web, it means that cybercriminals potentially have access to this sensitive data and could use it for nefarious purposes.

Should You Be Worried If Your SSN Is On The Dark Web?

One such service is how Hofmann, who filed the lawsuit, found out that his information has been leaked as part of NPD breach. There are many similar companies that scrape public data to create files on consumers, which they then sell to other businesses, Steinhauer said. The company added that it is working with law enforcement and government investigators. NPD said it “will try to notify you if there are further significant developments applicable to you.” Angela’s expertise is grounded in a passion for staying at the forefront of emerging threats and protective measures.

Changing your passwords is a critical step in securing your online presence after a potential SSN compromise. The dark web serves as a marketplace for cybercriminals to trade and sell stolen personal information, including Social Security numbers (SSNs). There are several ways in which SSNs end up on the dark web, often as a result of data breaches, hacking incidents, or the activities of malicious actors.

Risks Associated With Having Your SSN On The Dark Web

It’s a hub for cybercriminals to trade stolen data, including Social Security numbers (SSNs), credit card information, and login credentials. In an August statement on the security breach, the company said it’s cooperating with law enforcement and governmental investigators and conducting a review of the potentially affected records. Identity theft protection services can help monitor your credit and alert you to any suspicious activities. Some services also offer insurance to cover potential losses due to identity theft, as well as assistance in recovering your identity.

How SSNs End Up On The Dark Web?

Some financial companies, such as Credit Karma, can also help you freeze your credit. ZDNET’s recommendations are based on many hours of testing, research, and comparison shopping. We gather data from the best available sources, including vendor and retailer listings as well as other relevant and independent reviews sites.

Can You Be Affected Even If You’ve Never Heard Of National Public Data?

Instead, in most cases, it’s best to take steps to mitigate the consequences of a stolen SSN. Setting up 2FA won’t do you any good if cybercriminals have access to your phone number. With your SSN, they can contact your service provider to receive a new SIM.

Here’s How To Protect Your SSN From The Dark Web

Verify through reputable sources such as credit monitoring services, your bank, or services provided by government agencies like the Federal Trade Commission (FTC). With a credit freeze, the credit bureaus won’t release your information if a bank or other lender asks to see your report. And no lender will open a new account without first getting a look at your report. If you sometime in the future want to get a legit loan, you can lift the credit reports so your potential lender can get a look, and then you can freeze them again. Experian’s free credit monitoring service is one easy way to stay alert.

Your Social Security Number Is On The Dark Web: Here’s What You Need To Do Right Now To Stay Protected

The email said to put a fraud alert on my Experian credit file and also review my credit report. Does anyone have any experience with this – is this legit or is there a better process to follow? Keep a close eye on your bank accounts, credit card statements, and any other financial accounts. Look for unfamiliar charges or activities, and report any suspicious transactions to your bank or credit card issuer immediately. Discovering that your Social Security number (SSN) has been exposed on the dark web can be alarming.

If you’re not closely monitoring your credit card activity, the charges can quickly get out of hand. Even if you take steps to protect your credit, it’s important to keep a close eye on your existing accounts—including your bank account, credit card statements, and utility bills. You’ll need to request a credit freeze from each of the three major credit bureaus individually — Experian, Equifax, and TransUnion. They will each ask for personal data and provide a secret PIN to freeze or “thaw” your file when needed. You’ve likely never heard of National Public Data, the company that makes its money by collecting and selling access to your personal data to credit card companies, employers, and private investigators.

Both lookup tools are easy to use and search for different pieces of information in the stash. Both showed my personal information was stolen in the hack after I searched the different states I’ve lived in. Just note that to see if your private information is out there, you’ll have to enter some private information into the websites. Some of the exposed information includes Social Security numbers, home addresses, full names, information on relatives, and more. Concerned readers can find out whether they are one of the billions who are affected by visiting npd.pentester.com. To view important disclosures about the Experian Smart Money™ Digital Checking Account & Debit Card, visit experian.com/legal.